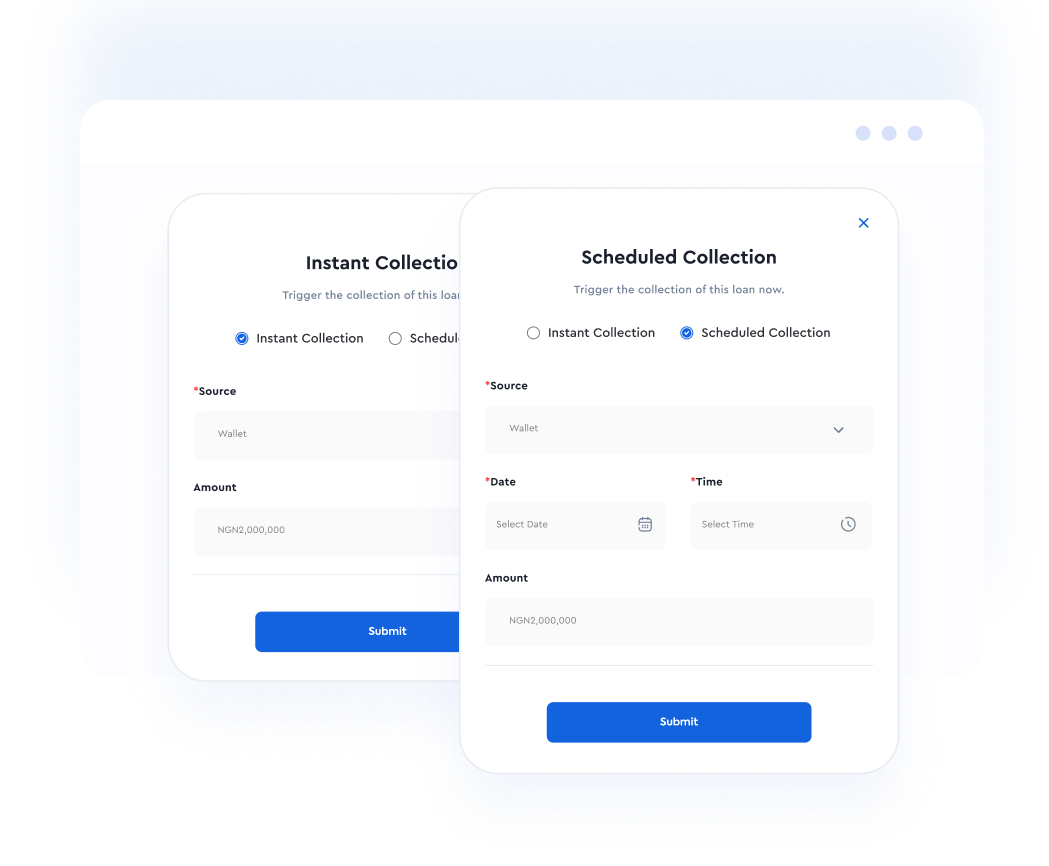

Collections you can trustCreate custom customer repayment plans, collect from multiple customer bank accounts and repayment channels, and minimize your default rate.

Disburse more, faster and securelyMake automated payouts and disbursements safely and quickly via local payment networks, SWIFT, or a custom channel of your choice.

Make faster credit decisionsDigitize and automate your identity verification, affordability modelling, and creditworthiness assessment to make faster decisions tailored to your credit policy.

01Collect financial information securely

Collect borrower's bank statements directly from financial institutions during loan application.

02Verify Identities

Take your KYC process to the next level. Automatically verify borrower IDs, addresses, bank accounts, and more.

03Automate affordability and creditworthiness assessment

Run credit checks with a click of a button. Integrate multiple credit bureaus and alternative data sources for smarter decision making.

01Collect financial information securely

Collect borrower's bank statements directly from financial institutions during loan application.02Verify Identities

Take your KYC process to the next level. Automatically verify borrower IDs, addresses, bank accounts, and more.03Automate affordability and creditworthiness assessment

Run credit checks with a click of a button. Integrate multiple credit bureaus and alternative data sources for smarter decision making.Delight your customers with a white label mobile applicationEliminate the cost and development time associated with loan app development. Give borrowers an interface that has all the features of a loan app and even more.

Request a demo

Schedule a Demo Call with us