Easily manage field agents and loan officersProcess customer data, your loan officers, and field agents in real-time and make faster decisions.Request a demo

Capture more of the marketModernise your business lendingWhether you’re lending to small offline businesses with manual processes or digitized businesses, manage the entire lending process securely on a flexible and intuitive platform.

Offline SME lending Fully-digital SME lending

Fully-digital SME lending

Digitize the activities of your field agentsReduce manual errors and improve customer experience by enabling field agents to collect and process loan application information remotely.

Automate credit assessmentAutomate credit risk assessment process and analyze data from multiple sources, allowing for faster and more accurate lending decisions.

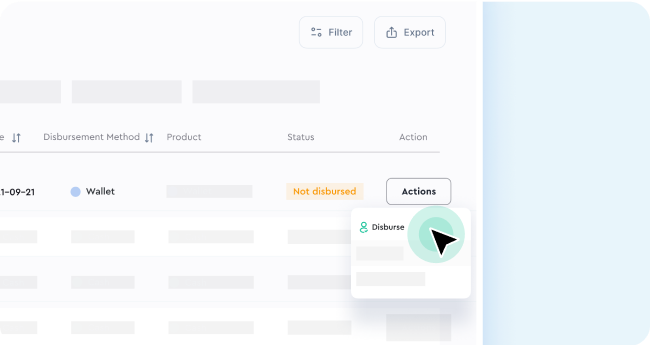

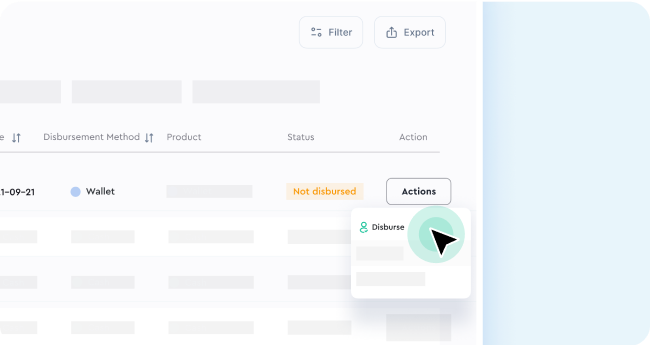

Faster loan disbursementFacilitate faster loan disbursement through digital payment systems, reducing the time and costs associated with manual disbursement processes.

Real-time loan monitoringEnjoy real-time monitoring and reporting of loan performance. Detect potential issues early and take actions to mitigate risks.

Automated collectionsAutomate collections processes through the use of digital channels, reducing the need for manual follow-up and improving the efficiency and effectiveness of the collections process.

Fully digital application processOffer a seamless application process that takes minutes to complete. Enable your customers to digitally sign the contract, receive the funds within 24 hours, and manage the entire loan online, just like a retail customer.

Easily verify business informationVerify business registration numbers, financial statements, and credit history information. Access all the third-party verification services you need in one place.

Advanced monitoring and analyticsBuild predictive models with in-house data and real-time credit insights from transactions and sales for faster decisions and cross-selling.

Faster loan disbursementFacilitate faster loan disbursement through digital payment systems, reducing the time and costs associated with manual disbursement processes.

Automated collectionsAutomate collections processes through the use of digital channels, reducing the need for manual follow-up and improving the efficiency and effectiveness of the collections process.

Make faster credit decisionsDigitize and automate your identity verification, affordability modelling, and creditworthiness assessment to make faster decisions tailored to your credit policy.

01Collect financial information securely

Collect borrower's bank statements directly from financial institutions during loan application.

02Verify Identities

Take your KYC process to the next level. Automatically verify borrower IDs, addresses, bank accounts, and more.

03Automate affordability and creditworthiness assessment

Run credit checks with a click of a button. Integrate multiple credit bureaus and alternative data sources for smarter decision making.

01Collect financial information securely

Collect borrower's bank statements directly from financial institutions during loan application.02Verify Identities

Take your KYC process to the next level. Automatically verify borrower IDs, addresses, bank accounts, and more.03Automate affordability and creditworthiness assessment

Run credit checks with a click of a button. Integrate multiple credit bureaus and alternative data sources for smarter decision making.Speed up your approval timeConsolidate and manage your entire lending operation from end to end on a single platform, eliminating siloes and boosting efficiency.

Create multiple loan products at no extra costGrow your portfolio through numerous loan products for different customer segments. Set up unique application requirements and collection methods for each loan product.

Get full visibility into the performance of your loan portfolioGet detailed analytics that shows your best-performing loan products, customer growth, repayment reports and other insights that allow you to make better business decisions.

Schedule a Demo Call with us